| The instructions in this article relate to Edit Invoice List. The icon may be located from within GLMax on your StrataMax Desktop or found using the StrataMax Search. |

Edit Invoice List (Invoice Code Setup)

Edit Invoice List is where invoice codes are created in GLMax for each type of item that a Strata Management company charges their buildings - outlined the management agreement. These invoice codes can be used to charge through Invoice Entry in GLMax, through TRMax for additional charges and services, or they can be used to charge regular Management Fees. They are also used in the automatic charging, which is set up in Disbursements.

These invoices codes can have a dollar value to charge for recurring services (tax returns, BAS preparation fees, etc.), items on a per usage basis (pages printed, hourly rate, certificates etc.), or they can be left as a zero dollar value for those items that have may have a variable charge between buildings (management fees).

These invoice codes must be linked to a GLMax income code, which is then linked to a StrataMax expense code in each building. This will allow any charges for a building to be reported on the GLMax income code, and also reported on the buildings Financial Statement as an expense. The set up of the link between GLMax and StrataMax has two steps, the first is to create the invoice codes and link them to a GLMax income code, and the second is done in Invoice Link Manager where the GLMax income code is linked to a StrataMax expense code.

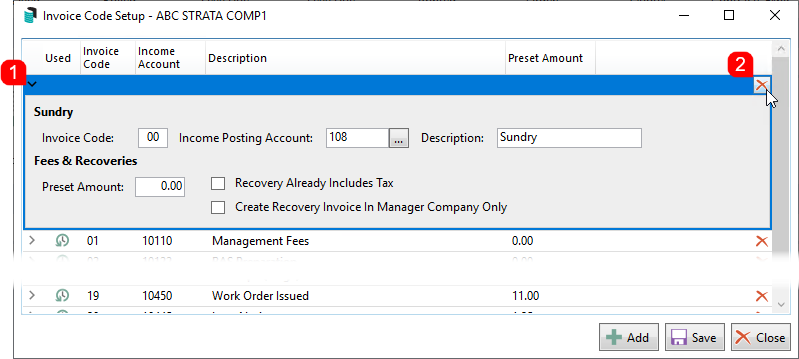

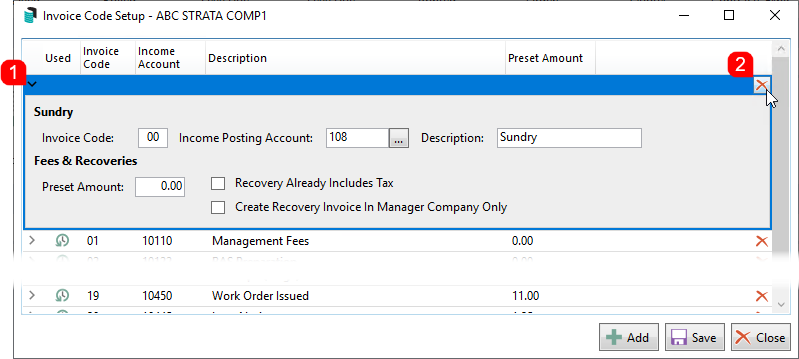

Creating a New Invoice Code

- Access GLMax, and open the Edit Invoice List menu.

- Click the Add button, and a new section will appear in the list of existing Invoice Codes.

- Enter the Invoice Code number (can be a combination of any two alphanumeric characters).

- Enter the Income Posting Account by clicking the ellipsis [...] button and selecting the code from the list.

- Enter the name of the recovery item in the Description field.

- Enter the amount to be charged for this item in the Preset Amount field, which will be the unit price when entering a new TRMax Recovery. If the item has a variable cost and will be charged at the time of entering, enter the amount as 0.00.

- Tick Recovery Already Includes Tax if the invoice code should not have GST added when TRMax recoveries are processed.

- Tick Create Recovery Invoice in Manager Company Only if the recoveries are only to be created against the GLMax debtors, but not process through to StrataMax.

- When done, click the Save button.

Editing an Invoice Code

Invoice Codes can be edited at any point in time. If the Description is edited and the Invoice Code is being used in the Management Fees Setup menu, the edited Description will be applied automatically.

- Open the Edit Invoice List menu.

- Click the Invoice Code to edit.

- Edit required fields and click the Save button when done.

Editing a Preset Amount will only effect new TRMax recoveries that are entered.

Delete an Invoice Code

Invoice Codes can only be deleted if they have not been used. If it has already been used, then a clock icon will be displayed in the Used column.

- Open the Edit Invoice List menu.

- Click the delete icon (the red cross located on the right side) on the Invoice Code to delete.

- Click on the Yes button when prompted to confirm.

Edit Invoice List | Report

- Open the Edit Invoice List menu.

- Click the Report button at the bottom of the menu.

- Excel will open displaying a row for each invoice item and a column for each value (invoice code, income account, etc.).