| The instructions in this article relate to Business Activity Statement and Income Activity Statement and the tax types available in StrataMax. The icon may be located on your StrataMax Desktop or found using the StrataMax Search. |

Business Activity Statement | Security

To access the Business Activity Statement, the user must have permission set to 'Allow' for Business Activity Statement under the 'Menu' category in Security Setup.

There is another permission named 'Balance BAS', a tool designed to view any potential transactions causing a variance. This will set to Deny as the default.

To be able to see and use the Delete button in the 'Prepare BAS' screen, the user must have 'Delete Business Activity Statement' permission set to Allow under the 'Menu' category in Security Setup.

Business Activity Statement (BAS) | Overview

Please note that StrataMax uses accrual based accounting practices for reporting and GST, there is no cash option available currently. See our FAQ's for more detail.

Businesses registered to report their tax obligations to the Australian Taxation Office can report the following tax types on either a BAS or IAS depending on which tax type has been registered:

- GST - GST on Sales, Expenses or Capital Acquisitions.

- PAYG Instalment - Instalment for Income Tax, based on the prior year's income tax return and non-mutual income.

- PAYG Withholding - Tax held from Wages to be paid on behalf of an employee.

If the registration is only for Instalment Tax, the form for lodgement is called an IAS or Income Activity Statement. The setup / registration for the above tax types is completed in Building Information.

The preparing of the BAS will report the data for the current period, allow the details to be reviewed, tax codes edited, variance to be checked, all in preparation for the finalising of the BAS ready for lodgement. There will now be validation between the current BAS that is being prepared, to the total of the GST Clearing Account for the same closing date. You will not be able to finalise the BAS if there is a variance larger than the configured tolerance set.

The finalising of the BAS will process the required Creditor Invoice transactions for the payment / refund to the Australian Taxation Office, provided the period is complete, payment references entered and within the set variance.

The BAS Reconciliation Report can be prepared for all buildings and sent as one PDF to be used for lodgement by a tax agent / accountant. The alternative option, is to use the Search BAS, to report all the required details for lodgement by the exporting to Excel for use by the lodging person.

Business Activity Statement Status

- Advanced filters for Building selection.

- Filters for Status for buildings that may be overdue or have issues, or to show all buildings.

- Building Name and Number.

- Account Group - will display the Account Group Name if is an Account Group Building (VIC) and not using a consolidated BAS.

- Status - current status to determine there are issues or if a building is overdue for lodgement or ready to prepare or finalise - see below for examples.

- Next End Date - displays the end of the next reporting period, determined by the registered tax and the frequency from tax setup.

- GST / PAYGW / PAYGI Start Date - will display the start date for the current period, if the tax is currently registered in tax setup.

- Actions - see below for details.

Status Information

These are examples of some of the various status messages that may be displayed and require action.

- Next BAS is Due to be prepared by - will display date (not overdue).

- BAS is Due by - will display if close to due date (not overdue) and waiting to be Finalised.

- Set the 'Don't Process before Due Date' in Tax Setup - the date must be set for the end of the prior period so the current period can be calculated - i.e. 30.06.24 will set the current BAS period to 01.07.24 - 30.09.24.

- BAS has not been prepared by <date> - will display if the BAS is overdue, based on the number of days entered in the 'Configuration' screen, in the Number of days after the end of a period that the BAS is due.

- Variance - A BAS will not finalise if the variance is higher that the configured tolerance.

Actions available on the BAS

- View Last BAS - The last BAS will be displayed and the option to print the report for selected building will be available, either with the default template or to Excel. This view will also show the transactions posted to the defined ATO Creditor as set in Tax Setup.

- Reopen Last BAS - This option will allow the prior BAS period to be reopened so important transactions that were not included can be updated, the re-finalise of the BAS will create adjusting Creditor transactions.

- Prepare a New BAS - The report for the current period will be prepared. The BAS can be edited, saved or printed. If the BAS is already prepared, a prompt to 'Edit the In Progress BAS' will be displayed to make selection to update any recent or updated transactions. An 'In Progress' BAS can also be deleted to allow the prepare to be completed again for the period to refresh all transactions.

- BAS Reconciliation Report - Will display the selected building BAS Reconciliation Report.

- Tax Setup - This shortcut will display the Building Information, BAS / IAS (GST) Registrations which can also be updated and saved.

BAS | Configuration

- Search or select Business Activity Statement.

- Click the Configuration button in the top right of the BAS window.

- BAS Variance Tolerance: This amount is the variance between the Clearing Account balance at the end of the reporting period compared to the expected BAS / IAS amount for the same period. The BAS will not be able to be finalised if the amount is greater that the set tolerance (StrataMax recommends a tolerance of $5.00 be set to allow for rounding as the BAS is reported to the ATO in whole dollars).

- Number of days after the end of a period that the BAS is due: Set the number of days to help with the timing for lodgement. Once the number of days is exceeded, the BAS will report as overdue with a red warning icon.

BAS Clearing Account Setup

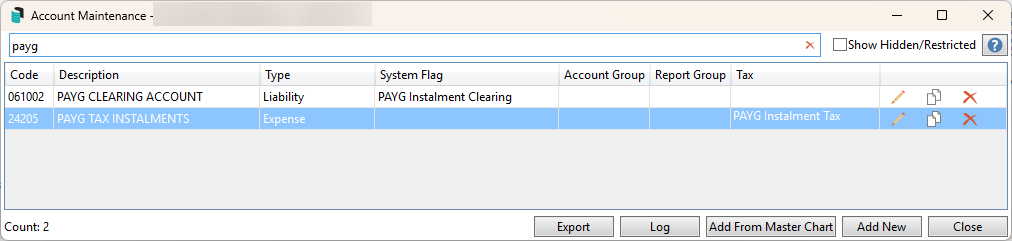

The setup of the Clearing Accounts is completed in Account Maintenance. The system flag will define which tax type and this will be used to process transactions to when the BAS is finalised. These account codes should not have any manual transactions created as they are system codes used to create the required transactions. Manual entries to these accounts will cause a variance to the relevant area.

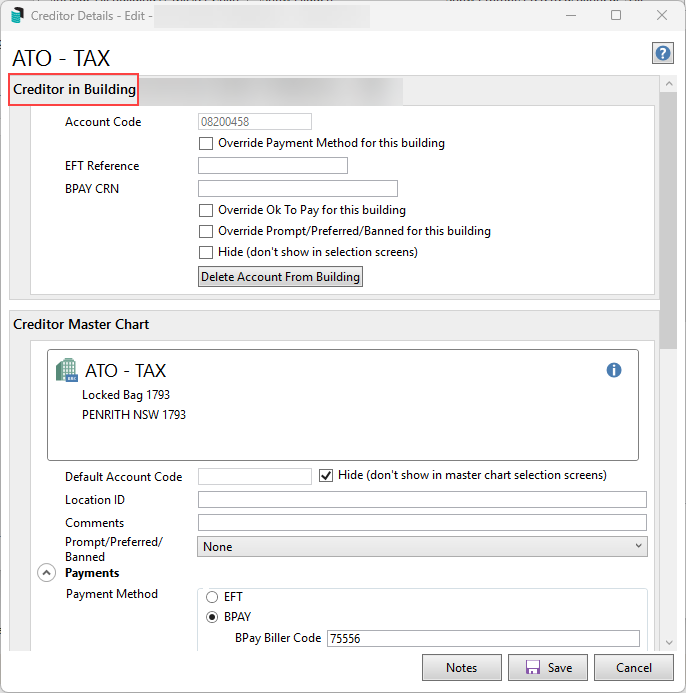

ATO Default Creditor

The ATO defined Creditor is set in the New Building Setup screen for all new buildings and amended in Building Information - GST / Tax Setup. The Creditor reference numbers for payment for BPAY or EFT are set in Creditor Maintenance.

Prepare the Current Period BAS / IAS

Preparing the current period for the BAS will calculate the GST transactions, including any new transactions that may have occurred. Once any variances or tax code adjustments (if any) have been addressed, and the prepare action is completed, it should also be finalised in the same process to ensure the total balance matches the reporting with what will be used to lodge with the Australian Taxation Office.

- Search or select Business Activity Statement.

- Select advanced filter options:

- Current building: Only the BAS for the current selected building (noted at the top of the window) is displayed.

- My Buildings (Account Manager): To select an individual Account Manager name and the properties they are listed for.

- Management Office: Select from drop-down list if being utilised.

- All Buildings: Displays all registered Buildings requiring lodgement.

- Show all: All buildings based on above selection.

- Show due or with issued only: Buildings that are due for review for the BAS period completed but not yet prepared or have issues.

- Show overdue or with issues only: Buildings that are overdue (based on configuration) for the BAS period completed but not yet prepared or have issues.

- Click the Prepare a new BAS button (small blue circle with white arrow) to update to the current reporting period.

- Review the Status column to resolve any issues and amend. If there is a GST Variance see below for guidance on how to investigate and resolve.

If the ATO SBR has been setup, in your office, with the appropriate credentials, once the BAS is finalised use ATO SBR to continue with lodgement direct to the ATO.

Finalise the BAS

Finalising the BAS is the last action to close off a BAS period and is used in conjunction with preparing the BAS. Once the BAS has been finalised, distribute the BAS reports for lodgement, ensuring all balances are exactly as per the ATO lodgement report. This action will also create the creditor invoice for payment or a credit note for a refund.

- Search or select Business Activity Statement.

- Select required Filter options for Buildings / Status.

- Select Prepare and Finalise to process all displayed buildings that have no issues. This will process the Creditor Invoices / Credit notes for the ATO Creditor as defined in the tax setup.

Distribute the Prepared and Finalised BAS Reports

The now-completed BAS/IAS reports can be easily distributed for use with lodgement at the ATO. There are two options for distribution. These reports can be sent to the accountant for lodging. For clients using the ATO/SBR Lodgement, this will be the next area to finalise for each BAS period.

Distribute BAS Report in a single report

- Search or select BAS Reconciliation Report.

- Select the cogwheel and ensure that Filter Buildings is set to All Buildings. Click Close.

- Click Proceed to preview the report which will include a single file. Use the Save icon and save the file to a network location. Or use the Email icon to send via email.

Distribute BAS Report individually for DocMax

- Search or select BAS Reconciliation Report.

- Select the cogwheel and ensure that Filter Buildings is set to Selected Buildings (separate report per building). Click Close.

- Refer to the Save Report area and set a profile that is appropriate for the BAS Report.

- Use the Building Selector Tool, use the Filters drop down and set GST registered. Tag all buildings. Click Select.

- Click Proceed. From the Preview window click Proceed again to file these into DocMax for each building.

It is important that the finalised BAS figures are lodged exactly the same when completed with the ATO.

ATO Payments & Refunds

The payment method selected for the ATO Creditor may be either BPay or EFT and will require the CRN or EFT Reference number to be entered for the BAS to be finalised. This information is entered into Creditor Maintenance in the local building section. When the BAS is finalised, it will automatically create the Creditor Invoices for Payment or Credit Notes for refund. ATO Payments can be processed via Payments once lodgement is completed and the amounts are exactly the same.

If a refund is due, once received in Process Bank Statements, it can be applied to the credit notes using Allocate Creditor for the ATO Creditor. The refund should be reviewed to ensure that the amount is the expected value to make the ATO Creditor account balance back to $0.00. The ATO or GST refund cannot be posted to PAYG Withholding Tax, GST Clearing or PAYG Instalment Tax accounts to ensure correct posting to the ATO Creditor account.

Individual Business Activity Statement

There may be times when a current period BAS for a specific Building / Plan requires review and amendments to be made. Once the current period has been prepared it can be reviewed and updated / amended. There may also be the odd occasion that the recently finalised BAS may need to be re-opened or possibly deleted - see below for further details for the most appropriate action for these scenarios.

Edit Current period

The most common adjustments required for the current / prepared BAS will be the adjustment for tax codes that may need to be updated if incorrectly entered on the original transactions. These amendments can be completed while the period is incomplete or after the end of the reporting period before the BAS is finalised.

- Search or select Business Activity Statement.

- Locate the Building to be Edited.

- Select the Prepare New BAS action.

- Select the section of the BAS to be reviewed - i.e. Tax Free Purchases.

- Locate the code to be amended in the section below and select either the:

- Code section to update all transactions in the selected code or,

- Select the individual transaction in the list once the code is selected.

- Use the pencil icon to display the current tax code and then amend as necessary.

- Select Save.

- Repeat for further tax code changes.

- Save and Close the BAS once complete.

Edit in Local Transactions

Editing GST on transactions is also available in Local Transactions and will assist with changing a tax code and updating the BAS area. This can be used for both current and prior BAS periods. Any tax code changes applied will affect the date-specific transaction and will be included in the most current Business Activity Statement.

Edit GST using Journals

Editing GST using Journal Preparation is done specifically and can be managed using the GST flag in the journal set. The example below includes an insurance premium payment that understated the GST, which now needs to be include more GST. If the example is overstated, complete the same steps but for opposite entries. Journaling directly to the GST clearing account is not recommended, as this will cause a variance, and using this method will take up the GST correctly.

- Search or select Journal Preparation.

- Click + Add Journal Set.

- Enter the date (noting that it will be included with the BAS period it relates to) and reason, and click the + Add button.

- Select the account and enter the amount required. Refer to the GST flag, which will include GST.

- Click + Add and select the same account code, tick No GST, and set the GST dropdown.

- Click Save / Close / Process.

Journal Preparation Set:

BAS affect:

Balance BAS Tool

The Balance BAS tool provides a view of potential transactions that may be causing discrepancies in GST and PAYG Withholding balances and is controlled via a Security Setup. This tool will be available to view when the variance is outside the set Configuration tolerance.

- Search or select Business Activity Statement.

- Locate the Building to be reviewed. Select the Prepare New BAS action.

- From within the Prepare BAS screen, select the blue arrow icon next to the variance amount. This can also apply to PAYG Withholding variances.

- Using the Balance BAS (GST) window, select the included transactions to identify what has been posted to the clearing account that could be causing the variance.

- Using this information, complete the required action with either a Creditor Invoice or Journal Preparation set to move this to the nominated account. If a journal is being completed to move the balance to a GST to reconcile type account, these must be investigated and resolved where possible.

GST Variance

The GST Clearing account total balance on the Balance Sheet at the end of each period, should match what is also being lodged. The GST Clearing account is only for transactions automatically created by the System. If manual entries have been allocated to this account, over time, you may have a variance. You may need to review with your BAS Agent or Accountant to assist.

If there is a variance on the GST, this will need to be investigated and resolved prior to finalising the current / next reporting period.

Why is there a Variance?

This is often due to transactions that are in the GST Clearing account in error or were manually entered and possibly not in the correct format.

There are likely to be three outcomes:

- The GST Clearing Account is wrong and a transaction/s need to be removed to resolve the variance. This is likely to be a journal to be completed in Journal Preparation i.e. Income Tax refund in GST Clearing Account.

- The GST Clearing Account is correct, however a manual amount entered into the GST Clearing Account previously should have be included on the BAS Lodgement. This is likely when an entry was created but not with the correct system details GST *** and would have then not been reported on the BAS. This variance will have been an issue since the original transaction occurred, however the prior BAS did not check the variance, which is a new feature. This variance should only require investigation and resolution on the first period using the new GST / BAS enhancements. This scenario will require a manual entry to the ATO Creditor for payment / refund and should also be manually included on the ATO lodgement, either for a prior period or added to the current period.

- Unable to determine a reason for the variance, journal to resolve this at a later time. This is a interim solution, as the above investigation is highly recommended. This option will leave a balance on the financial statements for reconciliation at a later time - this may need to be discussed with your BAS Agent / Accountant. A new balance sheet code may be added in Account Maintenance, for example "GST Adjustment", or "GST Variance" or similar. The date of the the journal must be in the current GST reporting period to correct the variance.

NOTE: It is not recommended that journals are completed to the GST Clearing Account after the variance is resolved, all adjustments can now be easily done in the BAS or using Local Transactions, Edit Tax Code.

There are only two types of transactions that should be in the GST Clearing Account – what are these?

- GST (Account Code) Transactions – automatically created.

- ATO Creditor account invoices / credit notes, posted when the BAS was saved.

How do I locate the manual Transactions?

Use Local Transactions to identify any entries that are not the above two system transactions – noting you may have to review old & historic year data. Use the Running Balance column to help and ensure that you increase transactions in Advanced if there are more than 1000 transactions.

Use the Running Balance to check the amount for the prior BAS – i.e. last June transaction running balance (rollover amount) should be the total for the June ATO Creditor amount.

What are some examples of the manual transactions?

- GST Refund – if allocated from the Bank Reconciliation, but the original BAS entry is already posted to the ATO Creditor.

- Income Tax Refund – incorrectly coded from the Bank Reconciliation and possibly should have been allocated to an income account or ATO Income Tax Creditor if a Credit Note was entered for the Refund.

- Journals manually applied to the GST Clearing Account – check the description and possibly extra details to identify.

Example

Manual transaction & ATO Refund

You will not be able to finalise the BAS if there is a variance larger than the configured tolerance set. Also review the GST, Tax and Wages FAQ which is constantly being updated.

Check the Local Transactions for the GST Clearing Account code for any strange looking items that may have been manually applied to the account in error. Example:

- ATO Refund (if should have been applied to the ATO Creditor instead).

- Opening Balances, should be reconciled to $0.00 for the first period after the setup of the Building / Plan.

- Opening Balances should always be applied to a separate account at setup so as to not be missed on the first reporting period, as these are manual entries to be lodged with the StrataMax BAS.

- Manual transactions that are not the same as the system created GST entries, as these will not have been included on the BAS.

Re-Open Last BAS

If a finalised BAS needs to be amended, the ReOpen Last BAS action can be used. Only the most recent / last period can be re-opened. It is recommended that this option is used with care and by guidance from your administrator / accountant / BAS Agent. As Creditor Invoices are created, when the original BAS was finalised, there will be new adjusting Creditor Invoices / Credit Notes transacted when the BAS is re-finalised.

Scenarios that may require the BAS to be reopened:

- Tax code updates required for one or more transactions that must be reported in the recently closed period.

- Note: These amendments, if minor can be completed in the current / next period by updating with Local Transactions.

- Auditor / Accountant adjustments.

- Lodgement for PAYG Instalment had a varied rate or percentage.

Delete Last Period

If a finalised BAS needs to be amended, the Re-Open Last BAS action must be used to access the Delete option. This option should be considered as a last option as the Re-Open BAS should assist to include any additional changes. Please discuss with your administrator if this is the correct action.

Scenarios that may require the BAS to be reopened then deleted:

- If incorrect balances are included and possibly are items that should be excluded.

- New tax type is registered - i.e. PAYG.

The delete option is only available if the original Creditor Invoices for the ATO Creditor have NOT been paid.

GST Conversion Account

GST Conversion Account is an account used to record the GST amount from opening balances from a prior manager. This amount should be reported to the ATO in the first period that the BAS is lodged, which will usually also include amounts that have been transacted in StrataMax for the remaining portion of the same period. This amount should have accompanying reports / documentation from the prior manager, so it can be lodged correctly with the ATO for Income / Expenses. Please refer to your accountant / administrator should you not be able to determine how to resolve this opening balance amount, this is external to StrataMax transactions and GST calculations.

PAYGI

Setting up a building for PAYGI can be done for all buildings, including those that are not registered for GST. The setup of these accounts is done in a similar way as the BAS accounts, and will use the Business Activity Statement screen to create the transactions.

Setup

Account Maintenance: ensure an account code is available for the PAYG Instalment Tax Code, including the system clearing account.

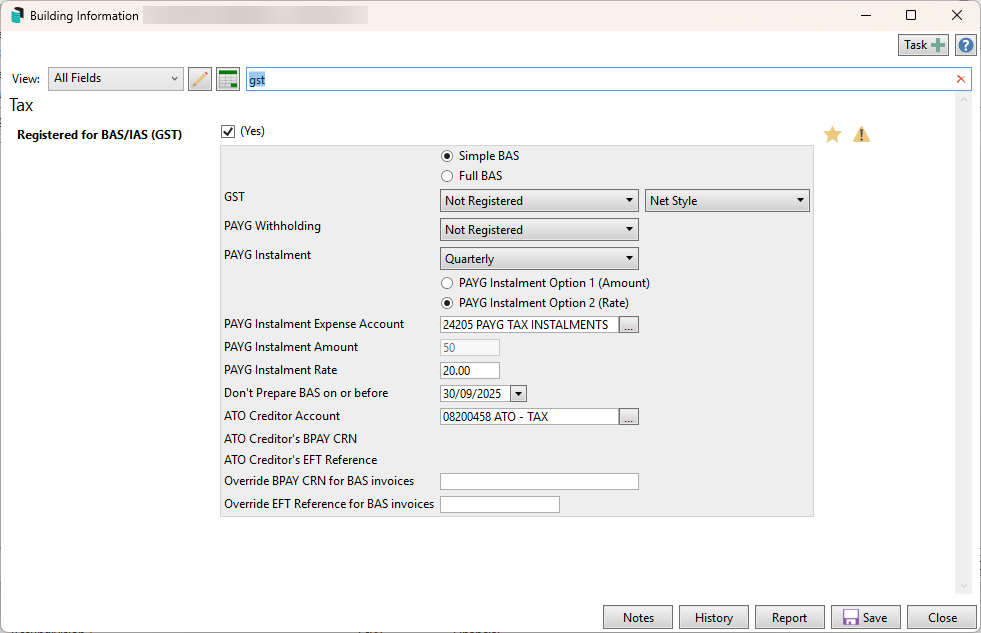

Building Information: ensure that the PAYG Instalment fields, which include PAYG Instalment with the relevant option, Instalment Expense, and Instalment Amount or Rate (depending on what option has been set). Don't Prepare BAS on or before (if a new building setup) and ATO Creditor Account.

Creditor Maintenance

When the BAS/PAYGI is finalised in the BAS screen, it automatically creates an invoice ready to pay the ATO. To ensure the payment is credited to the correct ATO account, a unique Payment Reference Number (PRN) is used. This unique reference can be entered into the Creditor in Building area with either the EFT Reference or BPay CRN fields.

Finalising the BAS and PAYGI Entries

Each instalment period, when you open the Business Activity Statement (BAS), there will be a current entry ready for review and finalisation:

- For GST-registered buildings, the entry will include both the BAS and the PAYGI instalment amounts.

- For buildings not registered for GST but with a PAYGI amount: Only the PAYGI entry will be available for review and finalisation.

When you finalise the current period, the system automatically creates an invoice to the nominated creditor account, ready for payment.

System-Generated Batches

Upon finalising the BAS, the system processes two batches:

- A transaction between the ATO Creditor and the PAYGI Clearing Account.

- A transaction between the PAYGI Clearing Account and the Expense Account.

Both batches are processed simultaneously, ensuring that the PAYGI Clearing Account ends with a zero balance.