| The instructions in this article relate to Account Group Setup. The icon may be located on your StrataMax Desktop or found using the StrataMax Search. |

Account Group Setup is to cater for Victorian Multi Owners Corporation (OC) setups. This is where there are multiple Owners Corporations existing within one Building. The below instructions are to configure these separate Owners Corporations into the one building / property. Like any normal plan, the strata roll will capture all lots and the below instructions demonstrate how to add a portion of the main lots to subsequent Owners Corporations, as per the registered plan of subdivision.

Please note that the set up of account groups MUST be done before any transactions are recorded in the building, including the processing of Opening Balances Setup. If an OC is set up before transactions are entered then additional OCs can be added into Account Group Setup at a later date.

Account Group information such as the ABN, TFN, GST Registered status and the Number of Lots / Entitlements is also displayed in Building Information.

Building Type

When creating a Victorian Multi Owners Corporation in StrataMax, the following combination of type, state, module should be set at the New Building stage or in Building Information.

- State = VIC

- Module = MultiBC

- Type = O.C.S.P

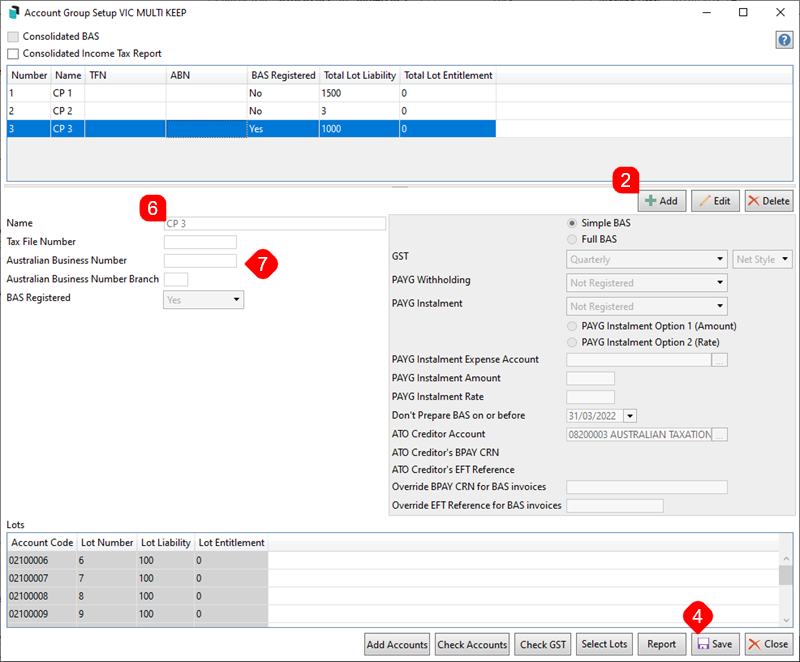

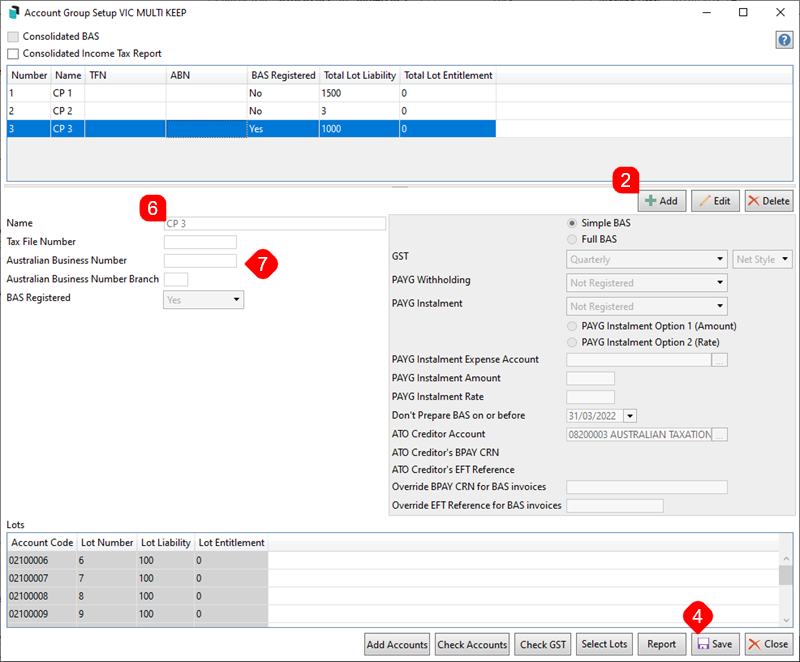

Account Group Setup

The Plan of Subdivision will determine the account group setup. Account Group or Owner's Corporation 1 will always need to be added, and usually contains all lots based on the Roll. Add the additional OCs, remembering to edit them to match the Plan of Subdivision. The account groups and entitlement schedules will be used for the creation of levies / fees when being entered.

- Search or select Account Group Setup.

- Click Add.

- Tag the required lots for the appropriate OC, click OK.

- Click Save.

- Repeat for any additional OC's, referring to the Plan of Subdivision.

- The 'Name' field should be reviewed, and this can be edited to a meaningful name. Highlight the account group required, click Edit, and title the OC Number appropriately.

- Update or add the Tax File Number, ABN, or BAS Registered fields.

- Click Save to save the changes.

Changing the BAS Registered field for a group higher than 1 (Account Group 1 is setup in Building Information) will affect if transactions calculate GST or not, based on selection when the change is applied and saved.

Use Local Transactions to adjust previously created transactions if required.

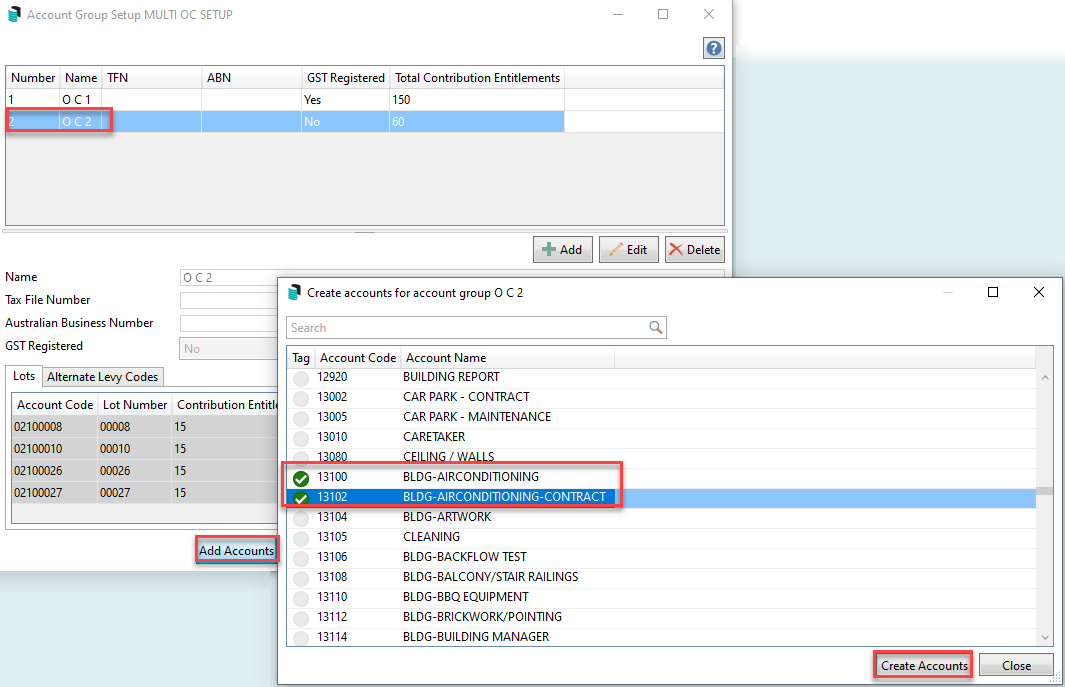

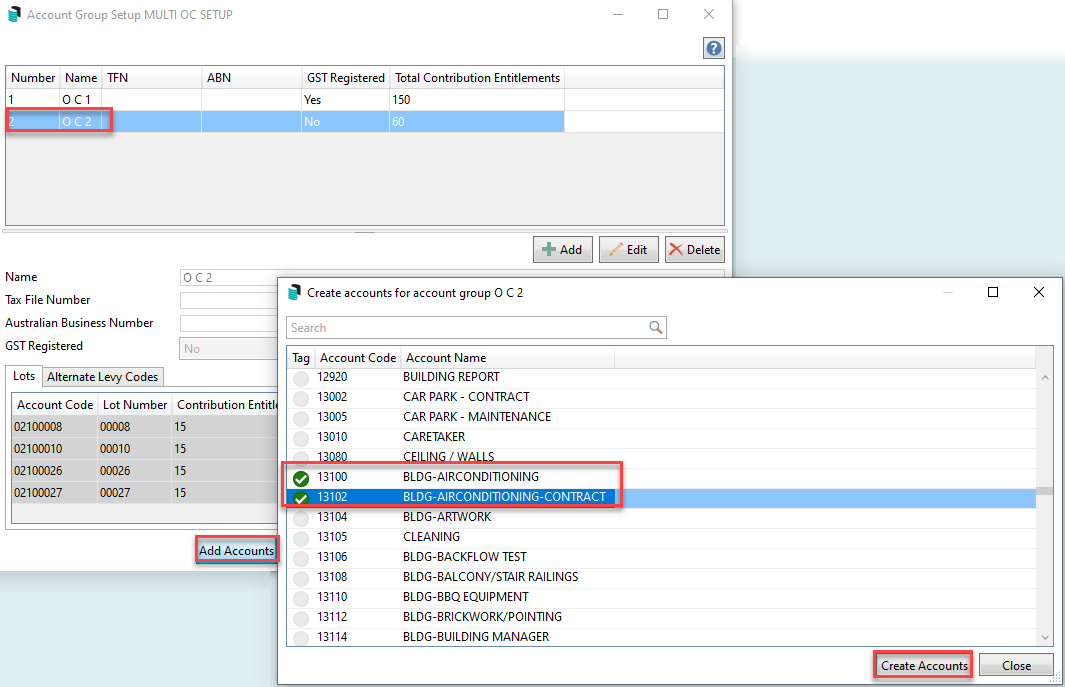

Account Code Setup | Add Accounts

Based on the setup above, a tool is available to create an account code for each Account Group with the Account Group specified. Account Codes can also be created in Account Maintenance, and have an account group-specific account code for Income and Expenditure.

Adding an Account Group will setup the required system accounts - including some income accounts based on Levy Invoice Code Setup. The below is mostly for adding required expense accounts and additional income accounts if necessary.

If adding more than a couple of account codes, it may be advisable to export the Master Chart of Accounts from Account Maintenance when in the Master Chart building. This will allow the codes already existing within the Master Chart to be reviewed, then map out the required new codes for the Building, particularly if to be used to assist Opening Balance Setup.

- Search or select Account Group Setup.

- Highlight the applicable account group name.

- Click Add Accounts.

- Tag each Account Code to be created for the applicable account group name.

- Click Create Accounts.

To create an account code, which is not in the Master Chart, follow the instructions to Create new Master Chart Account Code as normal (no account group) and then follow the above to add to the required account group.

Account Group Setup - Arrears Fees

When the building is set to use the Account Group Setup, the arrears code for the account groups should exist in both the Master Chart and the local building to which the account group setup applies.

- Using the Building Selector Tool, Select Master Chart Building.

- Search or select Account Maintenance and search for the main arrears code—for example, 085 Arrears Clearing Account.

- Using a similar number, Add New and create a similar clearing account using the last number for the OC. For Example, 0851 Arrears Clearing Account OC 1. Save this.

- Search or select Account Group Setup. From the OC's set in the top part of the window, select the relevant OC and click Add Accounts. From the Create Accounts for Account Group windows, search for the arrears code. Click Create Accounts.

- Click Save.

- Search or select Arrears Notice / Tools / Arrears Notice Setup / File / Arrears Fees Setup / Fees Account - Click Change and select the new account group account.

Multi OC Templates

- Levy Notice – LNOTE_MULTIOC208A or LNOTE_MULTIOC208C or LNOTE_MULTIOC205

- Arrears Notice – LEVYARR_MULTIOC43 (Reminder Notice) and LEVYARR_MULTIOC44 (Final Notice)

Reports

There are a number of reports available by Account Group. Refer to the headings below for a list of reports available by Account Group. The below prompt may appear, allowing for selection of the appropriate Account Group or Consolidated, when selected the data for that OC will report.

Account Group information such as the ABN, TFN, GST Registered status and the Number of Lots / Entitlements is displayed in Building Information and can be produced into a global excel report.

Reports available by Account Group

These reports will prompt or allow the selection by account group. Some reports may include additional information and items without account groups where an account is not specifically related to one account group.

Plan Report

Account Dissection

Transaction List (includes Lot Accounts)

Account Group Setup

Financial Statements plus Lot Balance Report

Voting / Meeting Register

Insurance

Certificates

Levy / Arrears Notice

Levy Register

Budget Reports / Lot Budget Summary report options

Reports unavailable by Account Group

Aged Balance List

Bank Reconciliation Report & Bank Transaction Report

Office Bearers

Levy Notice - Split Levy by Account Group

Business Activity Statement / BAS Details Report / Clearing Account Totals Report

Lot Budget Report Consolidation

When a budget report is selected from Financial Statements under File > Configure, there is a drop down which provides output options for Consolidated Reports. This is used when the Lot Budget Summary box is ticked when producing budget reports for a Multi OC property.

- One Line Per Lot: Calculations will be consolidated into one line per lot.

- One Line Per OC Per Lot: One Line for each OC in Lot Order. The lot total will be output.

- All OCs Printed in Order: Will output all OCs as though each was selected and printed. There will be an OC Total and each OC output will start on a new page.