This article covers setting up account codes and levy invoice codes, which is integral to setting up the utility sub-group.

The utility subgroup is one type 'attached' to the main group (building). For utility billing to function, new account codes must be created in each group, which will be used for billing, fees, and fund transfers. Tariffs also need to be set up, as they are used to bill an individual debtor for all utility charges, administrative costs, and other fees. As a general rule, each income account code is assigned to each Tariff, set up in the Utility Billing menu, and will be linked to the same account code in the main building.

The other subgroups, which can include a Marina or Air Conditioning type, use Levy Management to bill the debtors and include the update code process, which is set via Account Maintenance and outlined below.

Each account code will have transactions that need to be linked to the main building via an update code. When the billing is done, these will report immediately to the account codes set. It is recommended to set update codes the same in the main and sub-group, as this creates a simplified setup between each group.

Before creating account codes in the main group and sub-group, it's highly recommended that you determine all account codes required for the billing process (see the table of example codes below).

Create New Account Codes in the Main Building

The table below refers to a utility billing subgroup setup that uses all three utility types: electricity, water, and gas. Not all accounts may be required depending on the processes being applied to the subgroup. For example, if the arrears are not used, the clearing account balance sheet and income codes may not be necessary.

If a utility sub-group exists and has been operating, these codes should have been created, meaning this step can be skipped. These existing account codes will be ready to be copied from the Master Chart to the sub-group building, as outlined in the next section.

- From the building selector tool, select the sub-group Building from the Main change to the Sub-Group type.

- Search or select Account Maintenance.

- Select the required account code as noted below to complete the setup.

- From the Update Code field, select the Main reporting account code.

- Click Save.

*TIP: Tick Apply Changes to Master Chart & Buildings to include this for all buildings.

Balance Sheet

| Sub-Group Account Code | Sub Group Account Name | Main Group Account Code | Main Group Account Name |

| 021 | Levies in Arrears | 0226 | Utility Arrears |

| 031 | Second Debtors | 0227 | Utility Finalised Arrears |

| 061005 | Utility Arrears Clearing A/C | 061005 | Arrears Clearing Account |

| 012 | Cash at Bank | 012 | Cash at Bank |

Sub-Group Examples of Account Codes:

| Update Code in Main Building | ||||

| 10500 | Recovery - Electricity | 10500 | Recovery - Electricity | ||

| 10501 | Recov - Elec Admin Fee | 10501 | Recov - Elec Admin Fee | ||

| 10502 | Recov - Elec Srvc Fee | 10502 | Recov - Elec Srvc Fee | ||

| 10520 | Recovery - Water | 10520 | Recovery - Water | ||

| 10521 | Recov - Water Admin Fee | 10521 | Recov - Water Admin Fee | ||

| 10522 | Recov - Water Srvc Fee | 10522 | Recov - Water Srvc Fee | ||

| 10530 | Recovery - Gas | 10530 | Recovery - Gas | ||

| 10531 | Recov - Gas Admin Fee | 10531 | Recov - Gas Admin Fee | ||

| 10532 | Recov - Gas Srvc Fee | 10532 | Recov - Gas Srvc Fee | ||

| 10540 | Recov - Arrears Fees | 10540 | Recov - Arrears Fees | ||

| 10541 | Recov - Interim/Final Read | 10541 | Recov - Interim/Final Read | ||

| 10542 | Recov - Disconnection Fee | 10542 | Recov - Disconnection Fee | ||

Marina / Air-Conditioning Sub-Group setup

Financial records must remain in balance. For levy-related transactions (codes 012, 0220, and the related income account), the update codes to main must either all be set or all be clear.

Levies in advance or arrears are calculation-only values derived from the building’s levy setup. They are not posting codes and therefore cannot be synchronised between the subgroup and main. Changing the update code on these items will not have any impact.

Financial records must remain in balance. For banking transactions (code 012 and the related posting code—for debtors, typically 021), the update codes to main must again be consistently set or clear.

Financial accuracy requires balanced entries. One‑sided transactions cannot be posted directly to income or expense accounts without the corresponding balance sheet entry.

Before applying the setup for a Marina or Air-Conditioning Sub-Group, the key areas to consider are where to report income, expense and balance sheet (debtor account's). If these types of accounts should be included in the Administrative Fund, a simple setup can be applied to apply the update codes, and these will be reported in the Main Financial Statements for this fund. If this sub-group type should report the income and expenditure in its fund in the Main Group, an additional Trading Fund Setup should be applied.

The table below refers to the Marina or Air Conditioning setup using a simple Admin Fund type. Once these accounts have been created, it is recommended that you review the Levy Invoice Code Setup to ensure they are set correctly. This will allow Levy Management to create the charges using the correct income accounts. When the setup is complete and the sub-group is in use, a Certificate can also be produced to include the lot data for the marina fund.

| Balance Sheet Codes in Sub-Group | Update Code in Main Building | ||

| 012 | Cash at Bank | 012 | Cash at Bank |

| 021 | Levies in Arrears | 021 | Levies in Arrears |

| 0220 | Levies Billed Not Yet Due | 0220 | Levies Billed Not Yet Due |

| Update Code in Main Building | ||||

| 10500 | Air Conditioning | 10500 | Air Conditioning Billed | ||

| 10502 | Recovery - Air Con Srvc Fee | 10502 | Recovery - Air Con Srvc Fee | ||

| 10600 | Marina Fund | 10600 | Marina Fund | ||

| 10601 | Marina Fund - Annual Fee | 10601 | Marina Fund - Annual Fee | ||

System Account Codes

The following system codes in the sub-group will be automatically linked to their main corresponding account group. These are:

| Update Code | Main System Account Codes | |

| Opening Admin. Balance | 195 | Opening Admin. Balance | |

| Administrative Fund (Surplus/Deficit) | 401 | Administrative Fund (Surplus/Deficit) | |

| Total Funds Brought Forward | 409 | Total Funds Brought Forward |

Creating Update Code in the Master Chart

Update codes can be assigned in the Master Chart building, allowing any new sub-group to include these accounts, ready for immediate use. The instructions below refer to creating these at the Master Chart level.

- From the building selector tool, select the Master Chart Building.

- Search or select Account Maintenance.

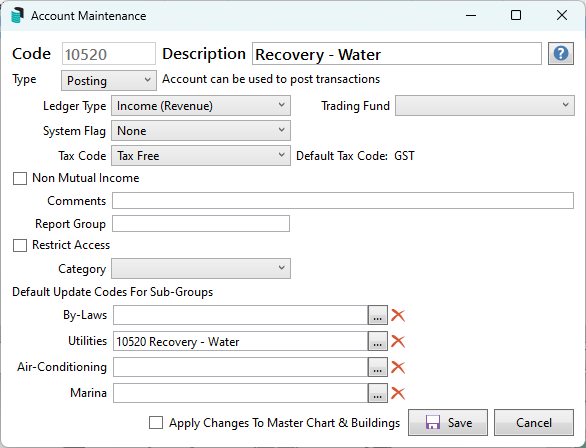

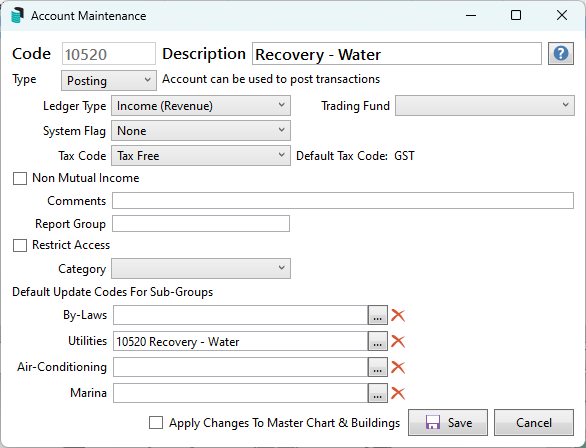

- Click Add New to create the income account used in the main building to report the utility income. Example 10520 Recovery - Water. If the utility type does not include GST, refer to the Tax Code field and set Tax Free.

- Click Save to add this account code to the Master Chart. Search for this same account code using the Search field.

- Click the pencil icon to set the Default Update Codes for Sub-Groups, which will be used for reporting in the sub-group. Example 10520 Recovery—Water.

- Click Save.

- Repeat steps 3-5 for any further account codes required.

To open Utility Billing, Account Maintenance still requires 101 administrative fund in the main and sub-group to have update codes applied. Check this account on setup and adjust the Default Update Codes for Sub-Groups account to match the setup.

Adding Master Chart Account Codes to a Sub-Group Building

Once the Master Chart of Account Codes has been set as above, the below instructions can be used to add these to a building that includes a sub-group.

- From the building selector tool, select the sub-group Building from the Main change to the Sub-Group type.

- Search or select Account Maintenance.

- Click Add From Master Chart and either search by account number or name, or scroll through to add the account codes as needed.

- Once located, click OK.

Copying account codes to Sub-Group Buildings

The Master Chart allows you to copy account codes to a building. Click here to review the instructions for completing this process. This can help you add the pre-set account codes without creating them again in a building.

Levy Invoice Code Setup

This area should be checked for all Utility Billing type Sub-Groups, and the nominated income account should be adjusted to match what is being applied in Utility Billing.

- Within the utility sub-group, search or select Levy Invoice Code Setup.

- Refer to invoice code 27 and amend the income posting account to match what Utility Billing uses.

- Change the Description to match the Utility Sub-Group type.

- Repeat for any other income accounts that are being applied.

- Click Save and close.

Levy Invoice Code Setup - Marina Fund

Below is a simple example of a Marina Fund Levy Invoice Code table that uses the standard Administrative Fund for reporting.

Levy Invoice Code Setup - Marina Fund using Trading Fund Setup

When a building has been set to include an additional fund to manage the Sub-Group, this is managed via the Trading Fund Setup for both groups and includes separate account codes for balance sheet, profit and loss and system account codes. Once this has been set, a Levy Invoice Code Setup must also be included that matches the additional fund set up.

Marina Sub-Group - Trading Fund Setup:

Account Maintenance using additional Trading Fund income account with update codes to match:

Levy Invoice Code Setup table example from Sub-Group: