The Statement of Key Financial Information can be produced separately or as an additional report to the Financial Statement.

Additionally, a Provision of Information about Industry Annual Return is prepared in WA and reported annually. These account categories below will assist in outputting the expense report data where required.

In NSW, a Statement of Key Financial information is required to be prepared for an Owners Corporation. Information can be found in the Strata Management Act 2015, Section 94 and the Strata Management Regulation 2016, Section 20.

Before the Statement of Key Financial Information can be created, the Income and Expense codes that the report will present must be categorised as either Bank Interest income or Administration or Maintenance expenses.

We suggest that any expense that is not an administrative expense would fall under a maintenance expense. However, it will be the sole discretion of the Strata Manager (NSW) to determine what category an expense will fall under.

Account Category (NSW)

An Account Category field in Account Maintenance is available to configure whether an account holds balances for administration expenditure, maintenance expenditure or bank interest earned.

These categories must be manually configured for both the Admin Fund and Capital Works Fund in order to obtain the correct totals for administration, maintenance and bank interest in the 'Statement of Key Financial Information' report. The account categories must be configured on ALL relevant account codes in order for the data to report correctly.

Adding an Account Category to Income and Expenditure codes

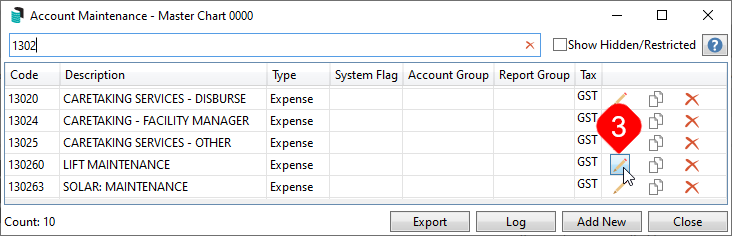

- Click the Building Selector and select the Select Master Chart Building link at the bottom.

- Search or select Account Maintenance.

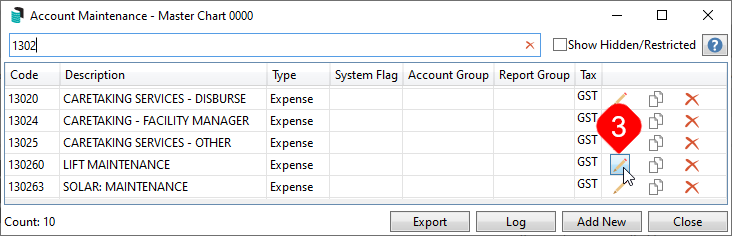

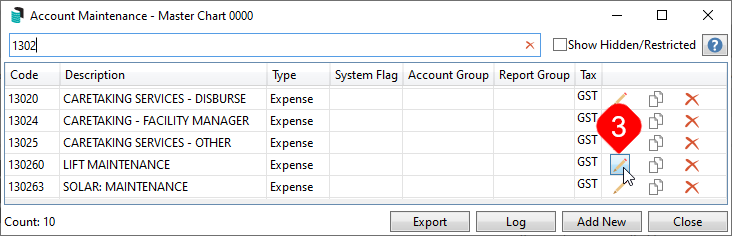

- Locate the income or expenditure account code to categorise, and click the pencil / edit button.

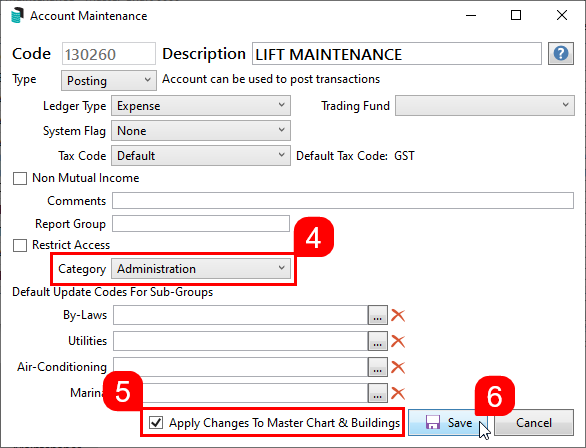

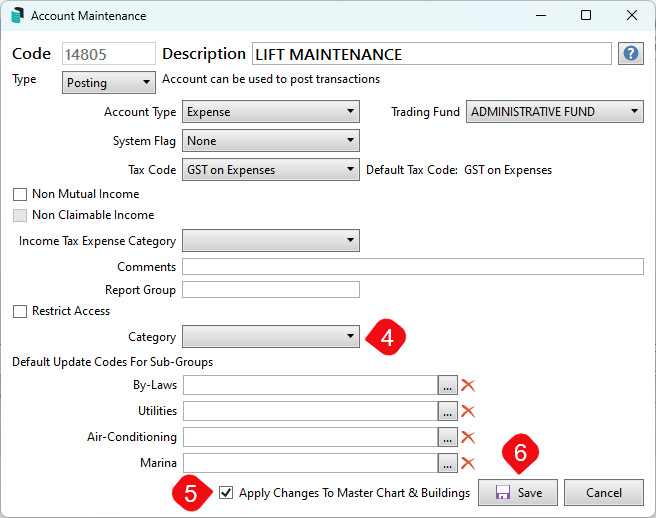

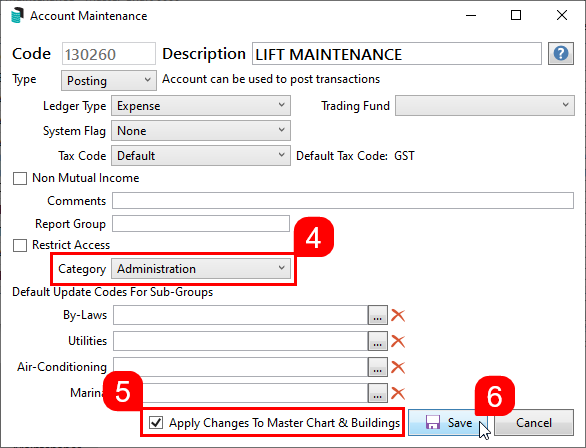

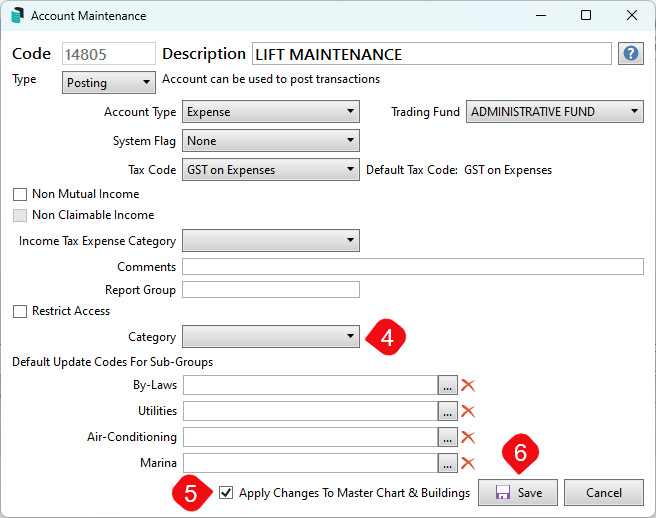

- Use the ‘Account Category’ drop down menu and click on the required category.

- Bank Interest - Set for any income code that bank interest is posted to, for example interest earned on investments.

- Maintenance - Any expense code that is a maintenance expense, for example repairs and maintenance to common property.

- Administration - Any expense code that is an administration expense, for example strata management fees.

- Tick the 'Apply Changes to Master Chart & Buildings' tick box if required.

- Click Save.

- Repeat this for all relevant income and expense code in both the Admin Fund and Capital Works Fund codes.

Identifying Account Codes Without a Category

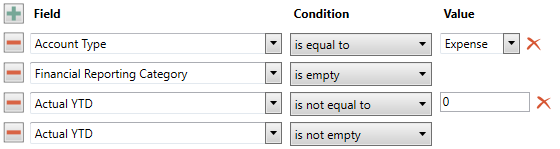

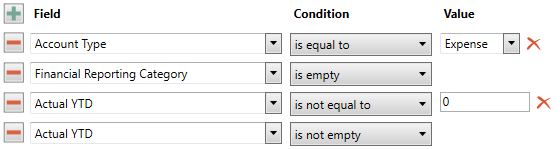

It is recommended to use Search Global Accounts to quickly identify account codes without a category set. Click on Edit to update an account code if required.

Restrict To:

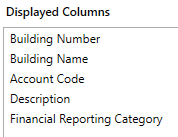

Displayed Columns:

Producing the Statement of Key Financial Information report

- In the required building, search or select Financial Statements.

- Tick the Statement of Key Financial Information checkbox. Tick Print Extra Report Only if required to exclude the Financial Statement.

- Select a Financial Statements report in the Report Name section.

- Click Proceed.

If a Statement of Key Financial Information is required with every Financial Statement produced, have the Save Settings as Default checkbox ticked to when producing the Statement of Key Financial Information.

This is a user setting per Financial Statement report type so each user must apply this default for each Financial Statement that they would like the Statement of Key Financial Information to be auto selected for.

How the Account Balances are Calculated

The Statement of Key Financial Information is broken down into the key information and the proposed principle items of expenditure for both the Administrative Fund and the Capital Works Fund.

This report is not a set of financials statement used for balancing purposes. It is only to highlight key information.

Balance Carried Forward

The closing balance from the previous financial year.

Total Income Received

The total amount of receipts received into the trust account, this includes all receipts received and not just levy payments.

Total Interest Earned

The total amount of interest earned based on the income codes with the account category of Bank Interest.

Total Contributions Paid

The total amount of contribution paid in this reporting period that has been allocated to the respective fund (Admin or Capital Works) based on the Levy Invoice Code. This can also include any payments for levies that raised in the previous reporting period (old year), paid in this reporting period.

Total Unpaid Contributions

The total of all unpaid contributions for this fund.

Total Expenditure for Maintenance

The total amount of expenses under the account codes with the account category Maintenance.

Total Expenditure for Administration Cost

The total amount of expenses under the account codes with the account category Administration.

Balance at the end of the report period

The total amount in the Owners Funds for their respective funds (e.g. 004 for the Admin Fund, 005 for the Capital Works Fund).

The items listed in the Principal items of expenditure for next reporting period is next year's budget. This is managed in Budget Update and displays the figures in the Budget Next Year column.

Account Category (WA)

An Account Category field in Account Maintenance is available to configure the total expenditure for a calendar year (1 January - 31 December) This will assist in reporting the required data to Landgate Return.

Adding an Account Category to Income and Expenditure codes

- Click the Building Selector and select the Select Master Chart Building link at the bottom.

- Search or select Account Maintenance.

- Locate the income or expenditure account code to categorise, and click the pencil / edit button.

- Use the ‘Account Category’ drop-down menu and click on the required category.

- Professional Services.

- Building Services.

- Property Services.

- Other Services.

- Tick the 'Apply Changes to Master Chart & Buildings' tick box if required.

- Click Save.

- Repeat this for all relevant expense codes in the Admin Fund and Capital Works Fund codes.

Identifying Account Codes Without a Category

It is recommended to use Search Global Accounts to quickly identify account codes without a category set. Click on Edit to update an account code if required.

Restrict To:

Displayed Columns: