| The instructions in this article relate to Ledger Card. The icon may be located on your StrataMax Desktop or found using the StrataMax Search. |

The Ledger Card displays a full history of an owner's account, including details of all debits, receipts, and discounts with the most recent transfer and last certificate issue date. The Ledger Card may be issued to owners and authorised contacts who have been configured in the Roll to receive information.

Preview Features

If access has been set for users via Security Setup, this screen can be toggled between the legacy and the new version.

For the individual user, this can be toggled from the Desktop as shown below by clicking on your user name / Preview Features. Tick Ledger Card to use Report Distribution.

This information applies to version v5.6.149 or later.

Information for prior versions is available from the Legacy Ledger Card area below.

Produce a Ledger Card

This option is designed to produce the information for the Roll contact. If the Ledger Card is being produced for internal purposes or requires multiple accounts to be included in one PDF file, use Report Set to select an internal or other user type.

- Search or select Ledger Card.

- Click the configuration cog wheel to review the Configuration - this is where you can set:

- The Style

- Start date for date range report and End date for date range report

- Do not calculate interest

- The Date for interest calculation (blank for Today)

- The Style

- Tag the account required by clicking on the ... ellipse to select the Accounts, click the Magnifying Glass (single-contact selection), or tick next to the Account to print a separate ledger card.

- Include any additional Reports or Attachment if required.

- Click the magnifying glass to preview the report, or click Proceed.

Ledger Card Internal Template

There is the option to change the Ledger Card Template to remove the Owners details, this may assist with producing ledger reports for a Lost Building or including with a Certificate. The following will be available on the Ledger Card Internal template:

• Name and Address will not display on the new template.

• Lot and Unit number will display.

- Search or select Report Set.

- From the list of available reports, search or select Ledger Card.

- Click the configuration cog wheel to review the template, and set this to Ledger Card - No Recipient. Click Close.

- Tag the account required by clicking on the ... ellipse, click OK and then click Proceed.

- From the preview window, click Print X Pages, Send X Email, Save to DocMax button.

Any additional configurations such as the Interest Calculation Date or the Deposit Slip can be adjusted by reverting to the Legacy Ledger Card using Preview Features.

Ledger Card | Cogwheel Configuration

Settings

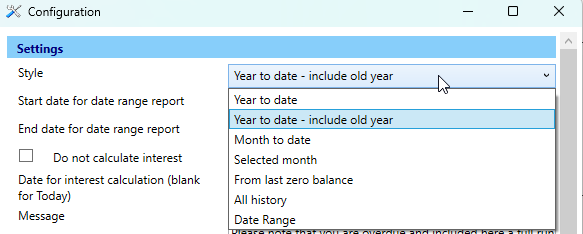

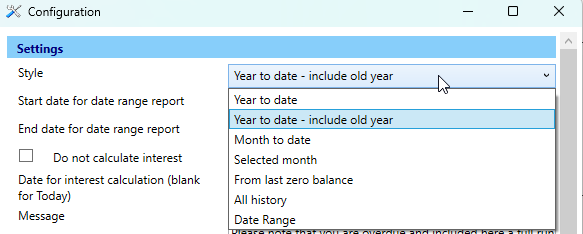

Style - see below for the available style period reporting.

Do Not Calculate Interest

Ticking this setting will stop the Ledger Card from calculating interest.

Date for Interest Calculation (blank for today)

This field will assist with entering a date for interest calculation. An example where this would be useful includes providing the Ledger Card with interest as at a certain date for settlement purposes.

Message (Global)

Text entered here will appear on the second page of the Ledger Card for all buildings.

Building Override Message (Building)

Text entered here will appear for just that building on the second page of the Ledger Card for all buildings.

Due Date Words

This will change the date or wording on the Ledger Card's deposit slip in the bottom right, provided a template with a deposit slip is being used. There is a 20-character limit.

Due Days

This setting is a number of days setting, which will produce the Ledger Card's deposit slip due date in the bottom right based on the number of due days entered here.

Edit Legal Action Words

This will change the wording on the Ledger Card when the owner is placed in legal action. Where the legal action words are placed will depend on the template that is being used for the Ledger Card. The wording is also limited to 30 characters, including spaces.

Legal Action Words

Wording set in this field will produce on the Ledger Card when an Owner has been added to Legal Action.

Skip Zero Balance Accounts (Global)

Using this setting to skip zero-balance accounts from being produced.

Template

Use Override Letterhead

This tickbox will ensure the override letterhead, if available, is printed on the Ledger Card. It will be set in conjunction with the field below.

Override Letterhead

If there are multiple letterheads available, this is where you can pick the override letterhead to be used.

Template

There are two templates to choose from:

- Statement/Ledger Card - Deposit Slip (used for Owner Distribution)

- Ledger Card - No Recipient - Deposit Slip (used for internal purposes and produced in Report Sets)

Template (Local Building Override)

The default is Use Global, and if a local building override is required, select the required template.

Report Sets

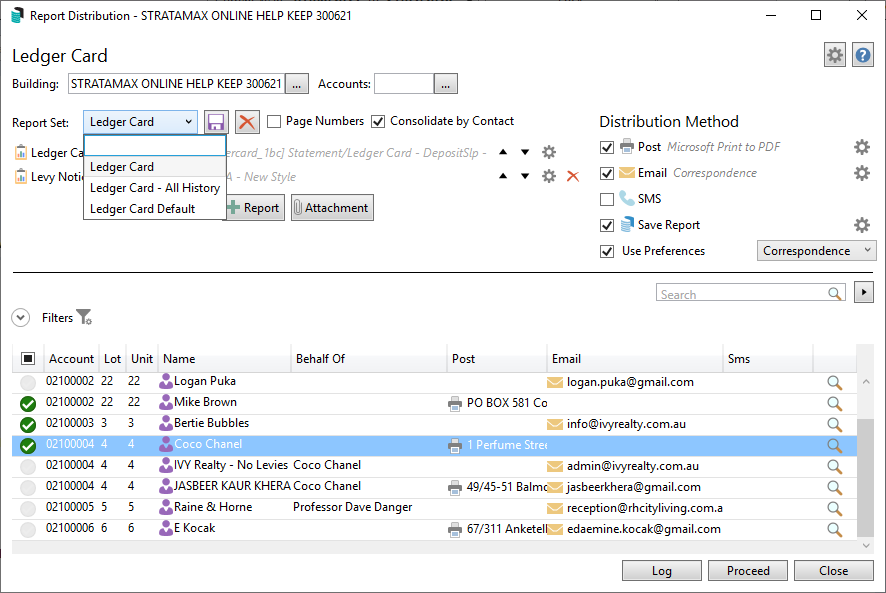

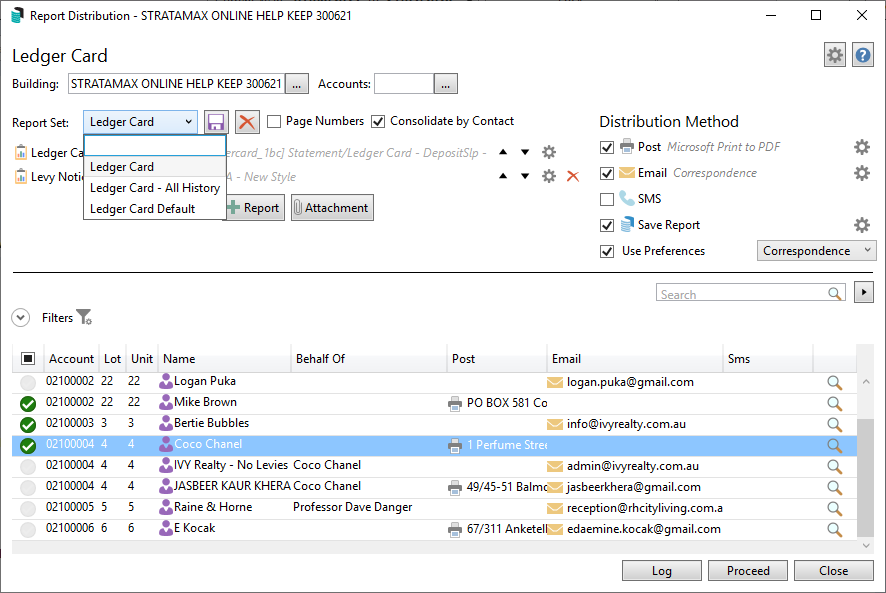

Each ledger card style and period can be set as a report set, ensuring a clean list of options and avoiding changes to the global template. Once these have been saved, the ledger card for the preferred format will be selected from the Report Set drop-down list.

Creating the Ledger Card Report Set

- Search or select Ledger Card.

- Click the cogwheel on the Ledger Card template and set a style. Click Close.

- Next to the Report Set drop-down, click the Save icon and give the Report Set a name. Example: Year to Date (based on the style)

- In the report set drop-down list, select the blank line, then click the cogwheel again to set the next style.

- Next to the Report Set drop-down, click the Save icon, then give the next Report Set a name.

- Repeat for each style.

Distributing the Ledger Card Report Set

- Search or select Ledger Card.

- From the Report Set drop-down list, select the style required.

- Either use the search to locate the Owner, or scroll to find the record.

- Tag the record(s) to preview the ledger card(s) and click Proceed from the preview window.

If the Ledger Card is required for internal purposes, use Report Set to select the Accounts and produce this for internal users.

Legacy Ledger Card

Please note that the information below applied from v5.6.149 and earlier.

To revert to the Legacy Ledger Card style, access Preview Features and untick the Ledger Card to use Report Distribution.

Produce a Ledger Card

By default, the Ledger Card prints with a deposit slip so owners can make a payment. This can be changed by clicking Options > Ledger Report.

If the deposit slip is not displayed at the bottom of the ledger, it could be that Ledger Report is currently selected in the Options menu. Click Options > Ledger Card to fix this.

If the property charges interest on unpaid levies (i.e. the Building Information field Overdue Levy Interest Rate has a number greater than 0.00) and you are preparing a lot account for settlement, a setting can be used so that the interest calculation amount appears on the Ledger Card.

- Search or select Ledger Card.

- Tag each of the accounts to print a separate ledger card for.

- Click Proceed.

Produce a Ledger Report

The Ledger Report produces the same information as a Ledger Card. The difference is the inclusion of the Deposit Slip on a Ledger Card. By default, the Ledger Report produces a Ledger Card with no Deposit Slip and fits more information on each page. If this is the last selected report type, remember to change the option back to Ledger Card. If the deposit slip is reporting on the ledger and you would like to remove this, select Ledger Report under the Options menu.

The tabs for the Ledger Report are the same for Ledger Card. See below for details on the Message and Conditions tabs.

- Search or select Ledger Card.

- Click Options > Ledger Report.

- Tag each of the accounts to print a separate ledger report for.

- Click Proceed.

Ledger Card/Report | Conditions

- Search or select Ledger Card.

- Click the Message tab, this will display any messages that will report on the Ledger Card. Ensure that you select the Print Message check box so the message will print on the Ledger Card. Message Maker will allow new messages to be created. The Message page will provide further instructions.

- Settings for the ledger card can be set in the Conditions tab.

- In the Transaction Order section choose from:

- Entry: To print the transactions in the order that they were entered into BCMax.

- Date: To print the transactions for this account in date order.

- Reference Number: To print the transactions for this account in reference number order.

- In the Report Order section choose from:

- Account Number: Will print the Ledger Card in code number order.

- Alphabetical: Will print the Ledger Card in alphabetical name order.

- In the Report Period section choose from:

- Month to Date: To print all transactions for the current month only.

- Year to Date: To print all transactions for the current year.

- Select Month: To print the transactions for the current month only. If this option is selected then you will be able to select the month directly below it.

- Include Last Year: To include any balance owing from the previous financial year on the ledger card. These will show as brought forward balances.

- Set the option No Print Zero Balance to not print any ledger cards for lot accounts whose transactions result in a zero balance.

- Due Days: If the deposit slip is being applied for the Ledger Card this will assist in controlling the due date printed in that area of the deposit slip.

Save these setting as default by clicking the Set as Default button so these settings are saved for every time a ledger card is produced.

- Select the Interest/Links tab by clicking on this heading. Type in the date to calculate interest up until by typing a date into Interest Calculation Date. If there is no interest amount set in building Information in the information field Overdue Levy Interest Rate, then no interest will be calculated. This interest calculation prints on the ledger card, but the entry is not added permanently to the account. If the lot is being settled, type in the expected settlement date. If there is an amount in the Overdue Levy Interest Rate information field and you do not want to calculate interest, then click on 'Do not calculate interest' to mark this option as active.

- Click Proceed.

Ledger Card & Report | Configuration

Address Preferences (Global Setting)

Displays a drop-down menu to select either the owner's Residential/Service Address or the Levy Notice Address when sending Ledger Cards or Ledger Reports.

Use Local Paper Source for Deposits (User Setting)

This box is ticked by default and it's recommended that it not be removed as it may adversely affect printing ledger card when using StrataMax on a remote desktop/server.

Always show last active global message (User Setting)

This should be ticked if the ledger card/report template being used has a Global message that is currently active under the Message tab.

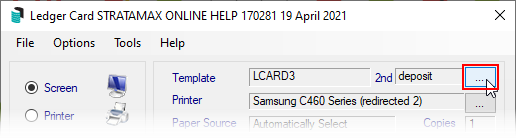

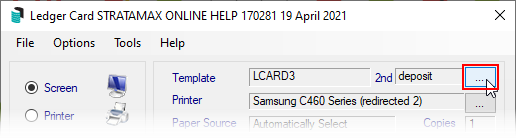

Ledger Card & Report | Templates

The ledger cards can be configured to use certain templates. Instead of having to test each levy template, here is a PDF with the ledger card templates available, for your convenience: Ledger Card Templates.pdf

- Click the ellipsis button next to the Template field in the top right of the Ledger Card screen.

- In the Template Selection screen, select the template required, and either click the Select as Global button to use the template for all buildings, or click Select as Local to use this template for the current building only.

- If you would like to preview the template first, select the template, then click the Preview button at the bottom.

- To change the preview style, click Options > Preview Style > Field Names or Field Numbers.

- Make sure you select the Deposit in the bottom section of the screen, and click the Select as Global button.

- Click Close to close the Template Selection screen.