|

The instructions in this article relate to Certificates, specifically for New South Wales. The icon may be located on your StrataMax Desktop or found using the StrataMax Search. Please see the Certificates article for instructions on how to produce a Certificate. |

Section 184 (NSW)

Please note that this article doesn't cover specifics around how to produce a Certificate. Please see the Certificates article for instructions on that.

To ensure the correct information is presented on the Section 184 certificate, specific Invoice Codes and Balance Fields must be maintained in the Levy Invoice Code Setup to ensure accurate Item Number representation. This is particularly important for additional costs, such as contributions for legal proceedings and pecuniary penalties.

Other items may have text added to them by clicking the Info Editor in the Certificates cogwheel area.

Sealing Clause: Copy the sealing clause from the Sealing Clause tab in the legacy version of Certificates into Info Editor. Review the Seal / Signature too if required.

Sealing Clause

The sealing clause is used in certificates to authorise the affixing of the common seal for the plan. You can set a default sealing clause, which will be affixed next to the seal/ signature for output on the Certificate.

Creating or Editing a Sealing Clause

- Search or select Certificates.

- Click the cogwheel on the certificate line from the Report Distribution window.

- Select Info Editor and use the Sealing Clause field to enter text into the global or this building only area.

- Click Save Changes to update the information.

The wording used in the sealing clause can be customised to suit your requirements; if there is no legislative requirement for any wording, a blank sealing clause can be saved and set as the default. Merge fields can be used to merge information found in Building Information or Office Bearers. The following legend shows the data that can be merged within the sealing clause.

| {BodyCorpManager} | The name of the Body Corporate/Strata Manager from Office Bearers. |

| {Title} | The Strata Plan Number or the name of the building. |

| {Name} | Name of the building. |

| {PlanType} | Plan Type in Building Information |

| {BuildingPlanNumber} | Either the Lot Plan Number or the Building Plan Number is output if the two differ. The Lot Plan Number will override the Building Plan Number on the actual certificate. |

| {CTSNumber} | CTS Number field in Building Information. |

| {RegMod} | Regulatory Module set in Building Information (If None, this will be left blank). |

| {FullPlanType&Number} | Same as {Title} or the Plan Type and Number. |

| {PlanNumber} | Plan Number field in Building Information. |

| {Date} | Date in the format of DD Month YYYY (e.g. 23 April 2019). |

Info Editor Fields

The following outlines which fields are available in Info Editor to output on the certificate in the relevant area. This information is also available for this building only and can be entered and viewed in the Building Information / Certificate Info section.

- Search or select Certificates.

- Click the cogwheel on the certificate line from the Report Distribution window.

- Scroll down to Info Editor.

Item 1 Has a Strata Renewal Committee been established?

From Info Editor, select this field and update whether there is a Strata Renewal Committee and a brief description or a renewal project.

Item 2 Administrative Fund Levies (Section 73(1) of the Act)

Levies generated for the Admin Fund use Balance Field 68 and will have Invoice Code 01 (the balance on the Certificate is Field 1204).

Item 3 Capital Works Levies (Section 74(1) of the Act)

Levies generated for the Capital Works are stored in Balance Field 70 and will have Invoice Code 07 (the balance on the Certificate is Field 1207).

Item 4 Amounts payable for additional amenities or service (Section 117 of the Act)

From Info Editor, enter whether there are amounts payable for additional amenities.

Item 5 Special contributions to the administrative or capital works or other fund (Section 84 (4) of the Act)

Levies generated for the Administrative Fund Special are stored in Balance Field 69 and will have Invoice Code 05 (the balance on the Certificate is Field 1208).

Levies generated for the Capital Works Fund Special are stored in Balance Field 71 and will have Invoice Code 11 (the balance on the Certificate is Field 1209).

Levies generated for Cost of Proceedings are stored in Balance Field 71 and will usually have Invoice Code 11 (balance on Certificate Field 166).

Item 6 Money unpaid under the by-law conferring a right or privilege (Division 3 of Part 7 of the Act)

Invoices generated for charges under a By Law are stored in Balance Field 74 and will usually have Invoice Code 15, but may be allocated to another Invoice Code (balance on Certificate Field 169).

Item 7 Proposals for funding matters set out in the 10 year capital works plan.

From Info Editor, enter this information: describe raising funds for the Capital Works plan. 'CertInfo14' will populate this section.

Item 8 Contributions towards cost of legal proceedings.

This observes Balance Field 75 and may be allocated to any Invoice Code.

Item 9 Amounts recoverable in relation to work carried out by owners corporation

This observes Balance Field 75 and may be allocated to any Invoice Code.

Item 10 Rate or interest payable on contributions

The 'Overdue Levy Interest Rate' field in Building Information is where this information is populated from. This will also calculate the daily interest rate based on the current outstanding amount, if any.

Item 11 Amount of unpaid contributions and pecuniary penalties

This observes Balance Field 73 and may be allocated to any Invoice Code (balance on Certificate Field 175).

Item 11A Particulars of Outstanding Orders

From Info Editor, enter this information: describe the particulars of any outstanding orders.

Item 12 Particulars on strata roll for lot to which certificate relates

Information is obtained from the Roll for the lot. If information is in the Entitled Person, Nominee, Other Persons or the Real Estate Agent tab, this information will also be displayed.

Item 13 Managing agent and building manager

Strata Managing Agent is populated from the Office Bearers screen, whilst the Building Manager will be populated from the Contracts Register for any record that uses the category of 'Caretaker'.

Item 14 Members of strata committee

This information is populated from the contact's information in the Office Bearers screen.

Item 15 By-laws

This text can be edited from the Info Editor / By-Laws field.

Item 16 Insurance policies

Populated from the Insurance screen.

Item 17 Contributions payable to administrative fund or community association or precinct association

Refer to the Precinct Schemes section below.

Item 18 Contributions payable to sinking fund or community association or precinct association

Refer to the Precinct Schemes section below.

Item 19 Contributions payable to the building management committee

Refer to the Building Management Committee section below.

Item 20 Amount payable to any other person or body

Click the Info Editor button on the right, in the Certificates screen, to open the Certificate Information Editor window and enter this information. Describe the details of any other person or body, the amounts payable, and the due date.

Item 21 Strata Scheme includes an exclusive supply network

The nature of relevant services provided by the exclusive supply network

Using Certificates, click the Info Editor button and enter the information to update the output into these fields. This building only is used for the selected building, or global default for this certificate to populate for all buildings.

Precinct Schemes

If both the Community Association and the Precinct Scheme are managed by the same manager, then the levy data can be collected from the Community scheme to populate under certificate items 17 and 18 in the Precinct scheme. If the scheme is not managed by the same manager, it can still be set to show the Community Plan's levy data; this will be required to be entered manually every time a certificate is produced.

In order for Certificates in a Precinct scheme to display levies and refer to the Association setup in the Community scheme, the following must be set up:

Community Association Scheme Setup

- In Building Information, the field 'Plan Type' must be 'C.A.D.P.' or 'N.A.D.P.'

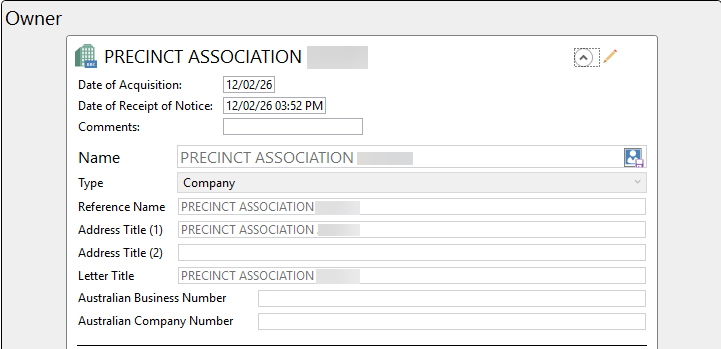

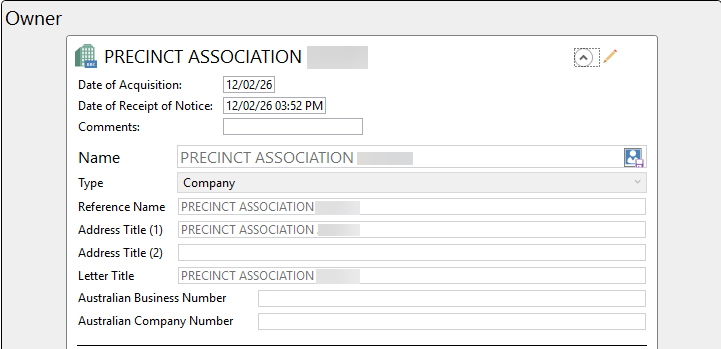

- In the Roll for the Precinct lot, the Reference name must contain the Precinct's Plan number, and specific text for the Owner's Name.

Precinct Scheme Setup

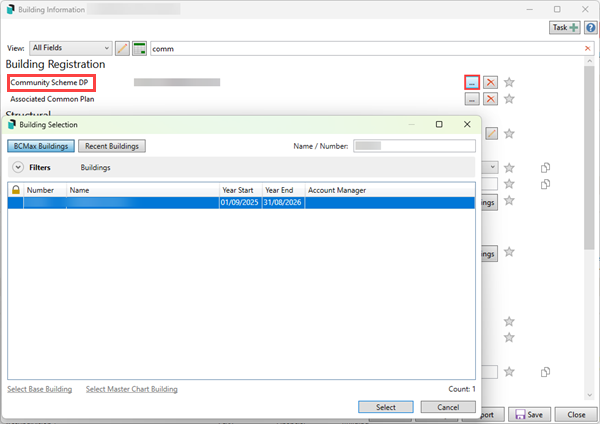

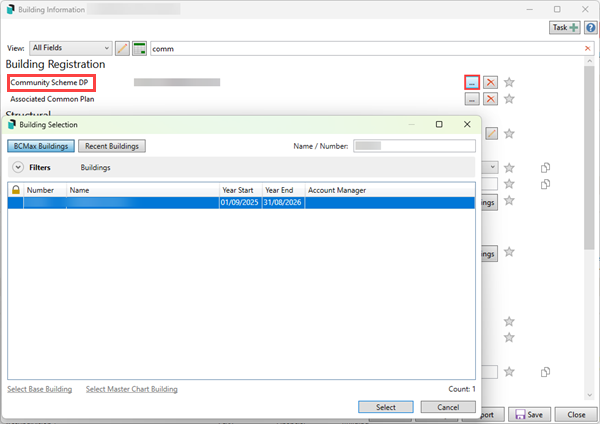

- In Building Information, the 'Community/Precinct/BMC DP' field must contain the Community Association's Strata Plan number, which is selected with a building selector tool.

One alternative to entering the fields if the Associated plan is not managed, is to enter data to refer to an external schedule which can be prepared outside of StrataMax, for example, in Excel.

Building Management Committee

If both the BMC and the Plan(s) that form the BMC are managed by the same manager, then the levy data can be collected from the BMC to populate under Item 19 in Certificates of the lots in the schemes that form the BMC. If the BMC does not have levies and uses percentage charges in the BMC screen, the balances on the BMC’s lot account for the scheme will be shown in Amount (if any) outstanding listed under Item 16.

The BMC information can be entered in the Info Editor area. This information is also available for this building only, to be entered and viewed from the Building Information / Certificate Info section.

To allow for the Strata Plans which form the BMC to display the BMC levies or outstanding amounts on their BMC lot account, the following must be setup:

BMC Building setup

- In Building Information, the 'Plan Type' must be set to COMPANY and the 'Regulatory Module' set to BMC.

- In the Roll for the Strata Plan lot, the 'Reference' name must contain the Strata Plan number.

Strata Plan setup

- In Building Information, the field 'Community/Precinct/BMC' must have the linked BMC building number.

If the above is set, Item 19 will display the Levies and the current outstanding amount if any. If the BMC does not have levies, text can be entered to identify that there are no levies or alternatively if left blank. In Certificates under the Special menu, select 'BMC No Levies Text (NSW - Strata Schemes Mgmt)'. If this is left blank, then the following wording will appear:

"This building management committee does not raise regular levies. Bills from member Strata Schemes are payable in accordance with the registered schedule of proportional liability for each expense item. For details of expenses a search of the member Strata Scheme's records should made be along with a search of the building management committee records."

If the scheme is also a member of an Associated Scheme and a BMC, then levies can be pulled through from both the Associated Scheme and the BMC. In the Strata Plan that is obtaining the levy information from the Associated Scheme and BMC, open Building Information and in the 'Community/Precinct/BMC' enter the plan number for the Associated Scheme, and in the 'BMC Community/Precinct exists' enter in the building number for the BMC.

Item 6 Work by Owners Corporation (Section 63)

Invoices generated for work carried out by Owners Corporation are stored in Balance Field 75 and will usually have Invoice Code 11 (balance on Certificate Field 172).

Item 7 Interest (Section 79)

Debits generated for Overdue Interest are stored in Balance Field 76 and will have Invoice Code 17 (balance on Certificate Field 173).

Item 8 Unpaid Contributions and Pecuniary Penalties (Section 206 and Section 80)

Invoices generated for Unpaid Pecuniary Penalties are stored in Balance Field 73 and will usually have Invoice Code 14 (balance on Certificate Field 171).

Invoices generated for Costs for Unpaid Contributions are stored in Balance Field 77 and will usually have Invoice Code 18 (balance on Certificate Field 77).

Amounts for Section 80 will appear under Other amounts owing. If Field 77 is used for Arrears Fees and Legal costs, then the word ‘Other’ may be edited to Section 80 using Edit Other Words (Special menu).

Item 9 Roll

Owner and mortgagee details are stored in the Roll.

Item 10 Managing Agent and Caretaker

Managing Agent and Caretaker details can be populated on Certificates from the Contracts Register. The contract information is entered in the register and then added to the Certificate.

- In Certificates, click Go To > Edit Contract Limits.

- Click Add.

- Select the Contractor for the Caretaker or Managing Agent.

Item 11 Executive Committee

Executive Committee member data is stored under Office Bearers.

Item 12 By Laws

This text can be edited from the Info Editor / By-Laws field.

Item 13 Insurance

Insurance details are stored in the Insurance screen.

Item 14 and 15 Associated Admin Fund and Associated Sinking Fund

Item 17 Other Person

Amounts payable to any other person or body is stored in the Certificate Information Editor screen. If there is insufficient space or there are multiple amounts payable, these will be stored in a document that must be set up for inclusion. Details will need to be maintained when they change.

Variations

If any invoice codes that are allocated to specific fields as described above are used for levies, then any amounts owing will appear under Other amounts owing. Levy details will be in an attachment. So it is preferable not to use those Invoice Codes for anything but their predetermined purpose.

If the Arrears Fee Invoice Code has been set up with a different Invoice Code, then the amount will still appear under Other amounts owing.

Invoice Entry

When entering invoices for items that are not levies selection of the correct Income Account is critical, because this will determine which Invoice Code and Balance Field will be used. Open the Levy Invoice Code Setup screen to see the details of the Invoice Codes and Income Accounts that they're attached to.

We understand that the above may appear complex, but it is important to remember that to achieve automated results, a little bit of planning will save many hours of repetitive work.

Additional Information

80 How does an owners corporation recover unpaid contributions and interest?

An owners corporation may recover as a debt a contribution not paid at the end of one month after it becomes due and payable, together with any interest payable and the expenses of the owners corporation incurred in recovering those amounts.

Interest paid or recovered forms part of the fund to which the relevant contribution belongs.

206 Unpaid pecuniary penalty is charge on lot

Any pecuniary penalty or part of a pecuniary penalty, the subject of an order under this Part that is to be paid by an owner of a lot in a freehold strata scheme to the owners corporation, is a charge on the lot until paid to or recovered by the owners corporation.

Any pecuniary penalty or part of a pecuniary penalty, the subject of an order under this Part that is to be paid by an owner of a lot in a leasehold strata scheme to the owners corporation, is a charge on the lease of the lot until paid to or recovered by the owners corporation.

The charge does not affect a bona fide purchaser for value who made due inquiry at the time of purchase, but had no notice of the liability.

63 What power does an owners corporation have to carry out work and recover costs?

(1) Application of section

This section applies if a person who is required to carry out work as referred to in this section fails to carry out the work.

(2) Work required by public authority

An owners corporation may carry out work that is required to be carried out by an owner of a lot under a notice served on the owner by a public authority, and may recover the cost of carrying out the work from the owner or any person who, after the work is carried out, becomes the owner.

(3) Work required to be carried out under term or condition of by-law

An owners corporation may carry out work that is required to be carried out by a person who is the owner, mortgagee or covenant chargee in possession, lessee (or in the case of a leasehold strata scheme, sublessee) or occupier of a lot under a term or condition of a by-law, and may recover the cost of carrying out the work from that person or any person who, after the work is carried out, becomes the owner of that lot.

(4) Work that is duty of owner or occupier to carry out

An owners corporation may carry out work that is required to be carried out by a person who is the owner, mortgagee or covenant chargee in possession, lessee (or in the case of a leasehold strata scheme, sublessee) or occupier of a lot in order to remedy a breach of a duty imposed by Chapter 4, and may recover the cost of the work from that person.

(5) Work required to be carried out under order

An owners corporation may carry out work required to be carried out under an order made under this Act, and may recover the cost of carrying out the work from the person against whom the order was made.

(6) Recovery of costs as a debt

The costs incurred by an owners corporation in carrying out any work referred to in this section may be recovered by the owners corporation as a debt.