Preparing for the end of a Financial Year on a building generally includes checking the financial and budget information at the end of the year. There are other areas that may need review and the purpose of this page is to assist with highlighting these.

Depending on when the account review is completed, there may be elements of producing reports from the old year. Any potential updates can be applied from the current year using Local Transactions and adjusting the Year field or using Journal Preparation with old year dates.

Areas available to report and process

Financial Statements

Financial Statements will assist in confirming both the Budget and Actual posted transactions. Having a copy of this information will assist before applying any changes to any accounts. Additional reports can also be included, for example the account summary report can be useful to check the description details and where expenses have been posted to.

- Produce a Financial Statement via Financial Statements.

- Interactive Reports

Transactions

Having a set of detailed transactions that include more commonly the expenditure of a building can be useful to refer to for individual transactions. There are a few options available to report this information:

Budget Review

Reviewing the Budget column and comparing this to the actual column is recommended to assist in identifying any account codes that might need movement to align with each other. Each line item should represent a similar value and be checked.

- The Budget column is included in the Financial Statements. This article here will include additional budget report options if required.

Editing and Updating Transactions

Based on the Financial Statement review, as noted in the two sections above, most of the editing and updating of transaction information can be done using Local Transactions.

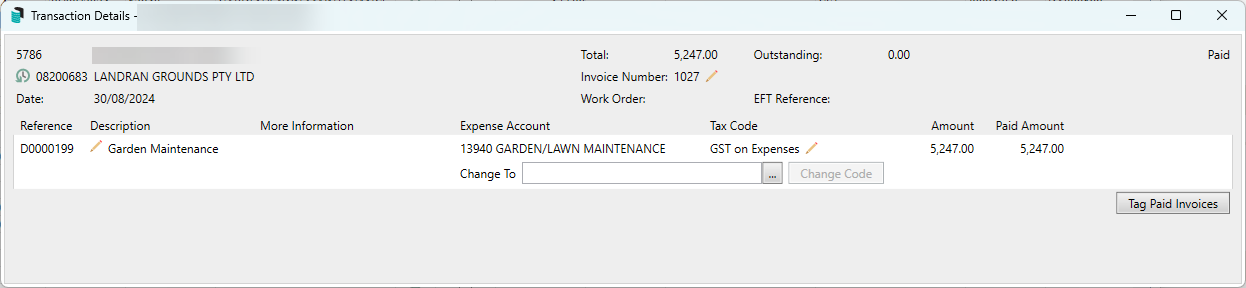

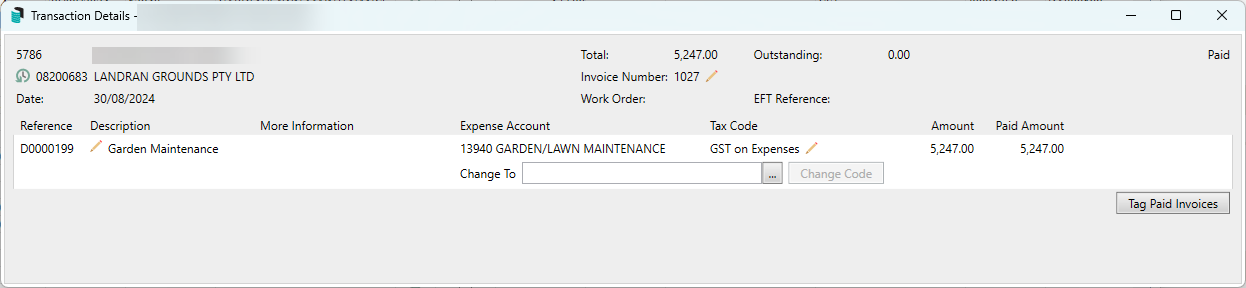

- Editing descriptions of paid invoices - When reviewing, if there are any that require a description change this can be edited via Local Transactions.

- Editing descriptions of other transactions, if there are any that require a description change this can be edited via Local Transactions.

- Transactions that may have been coded to an incorrect account use Local Transactions to move the transaction to a different income or expense account.

- For any transactions that are identified using GST incorrectly, use Local Transactions to correctly apply GST.

- If adjustments have been made throughout the year, transactions that balance to zero may be hidden using Transaction Report Manager.

The Change Code Number process will change the code number from the current year and apply to all years and this should be considered before applying.

- If there is an account code identified that requires all transactions including the Budget item, use the Change Code Number process.

- Journal Preparation can assist in other adjustments if the others above have not assisted.

Building Information

Once the financials have been completed and approved at the general meeting. The Audit Done setting can assist in marking the building appropriately.

Audit Done - Yes/No

Preparing for External Audit

Using Building Information - Auditor fields.

Using Report Set to distribute to Auditor / Save to DocMax / Email to Auditor.

DocMax - Saved Search for Auditor includes the categories required and then - Export to Excel, saving either to network folder or stick.