This article covers the process to be followed before completing the Year End Rollover in a Building Management Committees (BMC) or Shared Facilities building.

At the end of the financial year, the aggregate amount for general ledger expense accounts will be compared with the aggregate amount invoiced for each lot account (each member of the BMC). To even out the expense versus income for the end of the year, an adjustment should be completed on the last day of the financial year.

It is critical that this process is followed before running the Year End Rollover.

Adjustments Report

This report should be produced once all the bills for the year have been created, and before completing the Year End Adjustments function below.

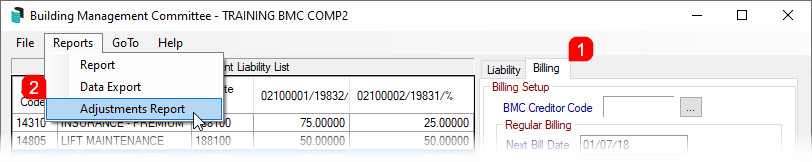

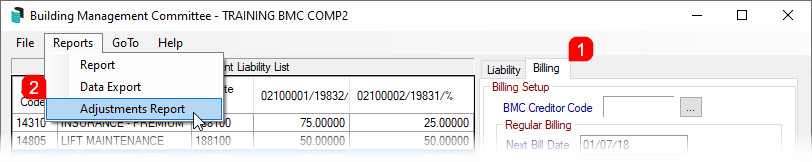

- Open the BMC menu and ensure the Billing tab is selected.

- Click the Reports > Adjustments Report.

- Tag one or all the lots and click OK

- In the Report Setup screen, click OK.

- Before year end is run, print the report and check the figures, see below the Adjustment Amounts.

A refund can be generated for each lot account in credit, but it is expected that the credit will remain in the lot account for the next year’s expenditure. Any ad hoc bills produced during the year will be deducted from the account balance before calculation.

Year End Adjustment

- Open the BMC menu and select the Billing tab.

- Click the Year End Adjustments button.

- If the expenditure amount is more than the amount billed (leaving the BMC in deficit), then a standard journal invoice will be produced for each building that forms the BMC in StrataMax.

- If the expenditure amount is less than the billed amount (leaving the BMC in credit), then a standing journal credit note will be produced for each building that forms the BMC in StrataMax.

- The Year End Rollover can now be completed in the Month End Rollover menu in the BMC.

Ad Hoc billing amounts will be added to the budget for this calculation.

Year End Troubleshooting

- If the expenses do not equal the income, check if there was a surplus or deficit before the building became a BMC (if it existed as a building previously).

- Check that all entries in the BMC have Ex ### in the details column.

- Check also any brought forwards figures as the BMC cannot manage a brought forward figures.